Managing property bills in Cabo can be a complex and frustrating experience for U.S. property owners. This guide will walk you through the challenges of international property payments and provide a clear, stress-free solution.

Why Traditional Payment Methods Are a Headache

Having property in Cabo, Mexico sounds like a dream, but it can quickly turn into a nightmare when it comes to the actual managing of the payments.

I’ve been there, staring in befuddlement at the forms I needed to fill out, ready to hand capsized meshugge to the expense account maintaining my budget as I wired funds back and forth, only partially successful in keeping international banking rules from tying me up like an errant dog on the end of its owner’s leash.

Challenging payment methods are traditional ones. They involve high wire transfer fees that can cost a property buyer 3-5% per transaction-a penalty that adds up to significant expenses over time. And why are they so high? Because this is the method that your sending and receiving banks use to pay each other.

These banks are bound by international rules of banking that are complex, with far too many documentation requirements that even seasoned property buyers find confounding.

And to add insult to injury, these traditional payment methods also involve time delays-miss a payment to a critical vendor, and you risk incurring late fees (if they’re even available) or getting tangled up in legal complications.

What Bills Can You Actually Pay Remotely?

Not every bill is the same when it comes to paying remotely. The kinds of payments that are typical in the life of an American can generally be divided into the following categories:

• Fees for the Homeowners Association (HOA)

• Utility payments (electricity and water)

• Taxes on property

• Renewal costs for the fideicomiso

• Expenses related to property management

If you’re doubtful about a particular bill being eligible for remote payment, we consistently suggest you check with your property manager or nearby lawyer for the exact answer.

How Local Payment Systems Actually Work?

The documentation required by Mexican banks can seem like a very complex and complicated maze. Local banking institutions generally ask for a huge variety of documents, which must be in order before they will even consider opening an account for a foreign national.

These documents might include legalized proof of property within the country, stamped and notated identification that shows you are a son or daughter of the U.S. with rights to live and work here, and even some tax documents (we’re not sure whose taxes the banks wanted).

You May Like To Read: Who Can Help Manage My Cabo Vacation Home?

Once you’ve wrestled all of that paperwork into some semblance of order, you might then ask how possible it is to get by without a local bank account. The answer is: not really.

The process requires more than just money; it needs a comprehensive understanding of local banking protocols. Successful transactions hinge on the conversion of currency, the timely transfer of funds, and the banking hours that dictate when money can be accessed.

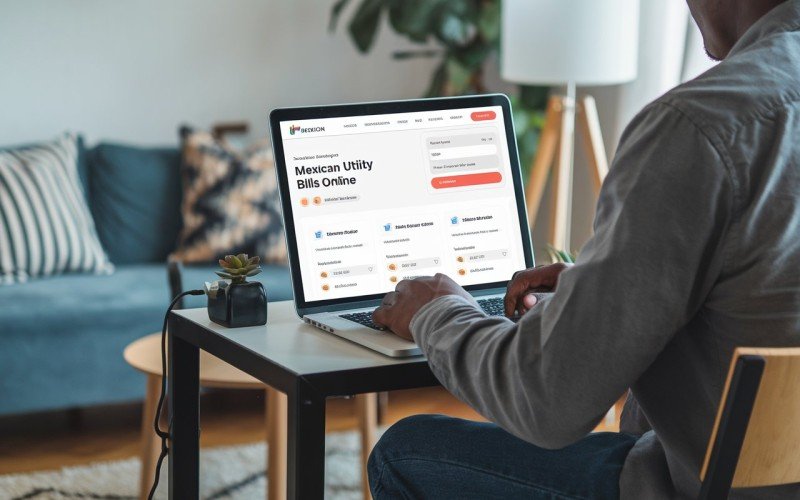

CaboBillPay: The Simple Alternative

We found a revolutionary answer after handling our own late fees and international wire problems. CaboBillPay connects the banking systems of the United States and Mexico-where my wife, Tracy, and I own property-so that we can easily pay all our property-related bills.

Their service offers a flat monthly fee structure. This means no unpredictability like what you get with traditional wire transfers. You can pay with your phone and not worry about whether the funds are in our account yet.

If a real-time payment is not possible, our service makes this clear upfront. All payments made through the service are secure, and we prioritize this element above all others when it comes to international property management.

Avoiding Common Property Payment Mistakes

Let’s discuss strategy. When it comes to international property payments, the right timing means everything. Here are some important things to consider:

• Ensure payment is planned at least 5-7 days in advance

• Maintain detailed records of all transactions

• Have a clear understanding of current exchange rates

• Keep a small account buffer for unexpected fees

Exchanging money can be difficult. Services that provide locked-in rates or minimal conversion fees can make this process less troublesome. It’s tempting to just go to the bank and do it there; I get that. But in the end, it’s almost always cheaper to handle your currency exchange some other way.

When you’re dealing with legal or tax matters, the value of professional advice cannot be overstated. An accountant or attorney who specializes in Mexican property law can give you counsel that is beneficial beyond the pay you render for it.

It doesn’t have to be stressful to keep up with property payments. You can change what might be a desperate situation into a manageable one with a few key techniques and some good tools.

Final Words

Take control of your Cabo property finances by understanding the payment landscape and leveraging modern payment solutions. With the right approach, managing your Mexican property can be simple, secure, and stress-free.