Owning property in Mexico comes with unique financial challenges. International property owners often struggle with complex payment systems, high transfer fees, and the stress of managing bills from afar.

This guide offers practical solutions to simplify your property payment process and save money.

The Real Cost of Traditional Payment Methods

It can seem like a financial minefield when you attempt to steer property expenses from afar. I’ve been in that position-gaping at the low-resolution screen of my laptop and trying to divine the actual cost of these international property transfers to my personal finances.

When it comes to traditional payment methods, most are just an unexpected expense (or two, or three) waiting to happen. And if you consider them a part of the navigation puzzle, they are certainly our most frustratingly insoluble piece.

Property investments can quickly make you feel light in the wallet, and one of the most insidious ways this can happen is through wire transfer fees.

These pesky little charges run $35-$50 (or sometimes more!) per transaction, plus extra hidden fees that many banks charge, such as currency conversion rates. Wiring money is a lot like sending a package. If you want it to arrive safely and on time, you need to plan ahead and not be shy about paying for the premium service that will get the job done.

What Bills Can You Actually Manage Remotely?

The positive aspect is that numerous costs associated with properties can be dealt with from any global location. Here are the principal payments that you can usually take care of from a distance:

• Fees for the Homeowners Association

• Taxes on property

• Payments for utilities

• Renewals of fideicomiso

• Charges for maintenance services

We always recommend checking with your local property manager or attorney first if you’re uncertain whether a specific bill qualifies for remote payment, especially when managing properties in areas like Cabo, Mexico.

You May Be Interested In: What Is The Best Way To Manage Property In Mexico?

Key Strategies for Smooth Property Bill Payments

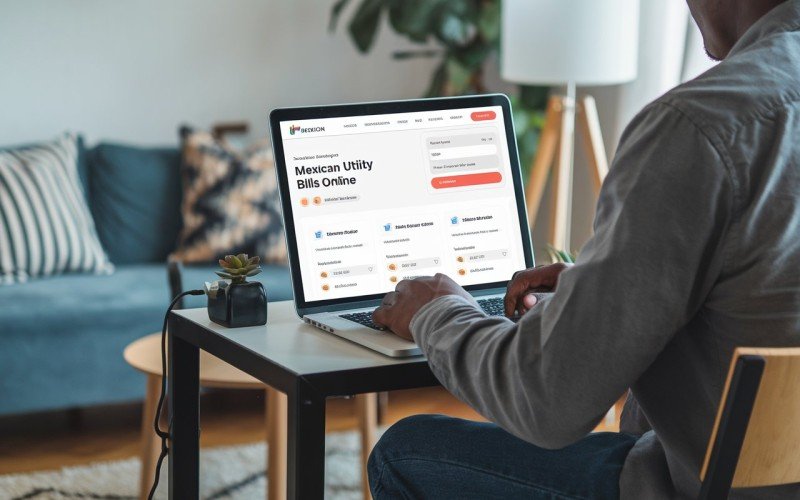

Grasping local payment systems is vital. The digital evolution of Mexico’s financial infrastructure offers a bouquet of solutions that enable remote payments, making them much easier than they used to be. Yet, understanding and choosing among the options requires some effort. Here’s a primer.

In this procedure, technology is your ally. Platforms such as Transferwise (now Wise), PayPal, and Mexican online banking can greatly simplify international monetary transactions. After grappling with late fees and problems with international wires, we found these services can save you time and money.

The crucial aspect is to discover a trustworthy payment platform that reduces fees and offers clear currency conversion.

Services that you can trust to provide real-time exchange rates and low transaction costs are ideal. Some platforms even let you set up automatic recurring payments, which is pretty revolutionary when it comes paying consistent bills like utilities and HOA fees.

For additional convenience, you might want to check out Cabo Bill Pay for specialized property payment solutions.

Why Local Knowledge Matters?

The most important lesson I’ve learned is probably that local knowledge is invaluable. Connecting with experienced property owners, understanding the nuanced legal considerations, and learning from those who’ve navigated these waters before can save you a significant amount of stress and money.

Owning property in a foreign land presents singular problems. Payment styles can vary not just from country to country but also from region to region within a country.

What problem might a property owner encounter in one part of Mexico that an owner in another part of Mexico wouldn’t even dream of? Here are a few issues we’ve come up with—aided by a network of local property managers, lawyers, and fellow property owners—that an online guide might not fully capture.

A handful of crucial things to keep in mind:

- If it’s possible, always preserve a local bank account.

- Maintain both digital and physical duplicate payment receipts.

- Know exactly what your property’s local jurisdiction requires.

- Cultivate a relationship with local service providers.

Handling the process of making payments for remote property bills can easily appear to be a complex undertaking. But if you approach it with patience, use the right tools, and possess a willingness to learn, you can change it into something manageable and, dare I say, even smooth.

Final Words

Take control of your Cabo property finances by implementing smart, strategic payment solutions. Don’t let complex international banking slow you down. Start streamlining your property management today and enjoy peace of mind.